Title : How to choose a Health Insurance Plan Health Life Media

link : How to choose a Health Insurance Plan Health Life Media

How to choose a Health Insurance Plan Health Life Media

How to choose a Health Insurance Plan Health Life MediaCheap health insurance may look taking into account a bargain, but what happens if you have a major medical problem? You don't want to be caught off-guard if an terse major medical suffering arises. Cheap health insurance means one business to one person and something else to another. though the idea of getting cheap health insurance is very appealing, no one wants to harmony gone the repercussions of bad or inadequate health insurance. Cheap health insurance has become the issue of the moment in South Carolina and across the country. More small businesses are increasingly unable to present cheap health insurance plans to their employees because of the rising cost and the dearth of federal and come clean legislation that would allow small businesses to buy cheap medical insurance in pools.Cheap health insurance is your entrance to the best options in the market. This is because you no longer have to spend so much become old searching for the product that will combat your health care needs. Cheap health insurance rates performance fittingly much augmented considering you know what you are supposed to be looking for. acquire some tips on what you should see for once dealing behind a health insurance plan. Cheap health insurance quotes can assist you to find the best and the most reasonably priced coverage that is available. You will be covered, and relieved to know that if whatever happened to you, you will not have that major financial highlight of paying full price for your injuries or illnesses.Medicare supplemental insurance offers senior coverage for health care costs that are not covered by a time-honored Medicare plan. By having Medicare supplemental insurance, seniors can rely on consistent, constant and whole coverage later they need it. Medicare supplemental insurance is meant for people on Medicare, who hope to have more collection coverage. These supplemental plans may add together Managed Care HMO plans or Medigap PPO plans that have the funds for you gone greater access to participating physicians. Medicare and Medicaid are both excellent programs for those individuals who qualify, but they are no the stage for a system which allows us all to access basic private medical insurance cover at a cost which we can afford.Medical Insurance as a consequence known as health insurance is a guidance to individuals and their families next to unforeseen expenses. In the process, there are two parties namely the insurer and the insured. Medicaid is for people who come below the low income's bracket. all person is eligible for it and having a job does not work one's eligibility. Medical terms can be confusing, and in the past speaking like an insurance agent, you should make clear you understated his or her language. create positive you retrieve our overview of health insurance companies to acquire a improved idea of each provider's identity.Individual companies are clear to scrutinize the risks to insure you in all ventilate they look fit. Each health insurance company employs people (actuaries) that try to calculate the statistical risks keen in insuring you, and not surprisingly, has a slightly interchange view of the statistics. Individual health insurance works differently. It generally can't be terminated just because you use it, but you can be turned alongside in the first place if you realize not pass health underwriting; you can be rated in the works if you have a history of illness or obesity; and your premiums can be and often are increased if you tersely have a major illness. Individual health insurance covers alternative types of injuries as well. An swift lifestyle increases the risk of accidental injuries and repairing damage bones can become definitely expensive.Individual health insurance is make a clean breast specific. Each come clean has slightly alternative laws and regulations governing the implementation of private individual health insurance.Hospitalization, medicines, doctor fees can be very high and if the patient cannot acquire a all right insurance cover, it is no question difficult. Health insurance can be a tough fight for cancer patients. Hospitals have an fantastic endowment to keep enthusiasm and without health insurance you could be medically saved but financially ruined. Hospital cash plans are a form of medical insurance that takes care of nameless medical costs. Many will pay for dental or optical treatment taking place to a set limit all year; physiotherapy; specialist consultations etc.Comparison of your options: To be adept to find an affordable health insurance you must have an idea of all. What is simple in the market? After you have shopped tolerable get sustain of a broker who can urge on you in comparing the policies. Comparing health insurance is a conflict of finding the right health insurance provider to cover your particular circumstances as without difficulty as comparing the types of policy provided by each health insurer.Comparing Medical Insurance isn't just a prosecution of finding a handful of brand names and trusting they have anything covered in their policies. The cover varies wildly, as will your medical insurance quotes. Compare several plans from top rated medical insurance companies and apply online.COBRA, rapid of Consolidated Omnibus Budget Reconciliation Act, came into brute in 1985, and it is along with a low cost health insurance another for short-term coverage stirring to 18 months. It's great for transition periods such as intellectual age children, widowed spouses, divorced couples, and extra situations where you may have been covered by employee programs previously. COBRA has an 18 month limit, or 36 months if you're permanently disabled. Most people are below the look that COBRA is expensive, or that it's greater than before to stay afterward a scheme they know.Again, depending on where you live, requirements may be stringent. However, it wouldn't harm to look if you or your intimates qualifies. question nearly to locate out approximately the every second agents and their policies. Many agents will sham agreed hard to get you an affordable health insurance plot for your family at a cost you can rouse with. question if the agent will be open for phone calls and if he or she will make phone calls upon your behalf if you have questions in the future. question your agent to be sure.Ask for a quote from several sources, and look what kind of a deal, they can get for you. create positive they are next licensed in your state, because it does no good getting insurance if they can't exploit in your state. ask not quite policy rates, terms, services, co-pays, and claim procedures. If the representative has a difficult time answering your questions, or you just don't think the company is legit, decide visiting your state's Department of Insurance website to entre through reviews and financial guidance of the company.

Related Post How to choose a Health Insurance Plan Health Life Media

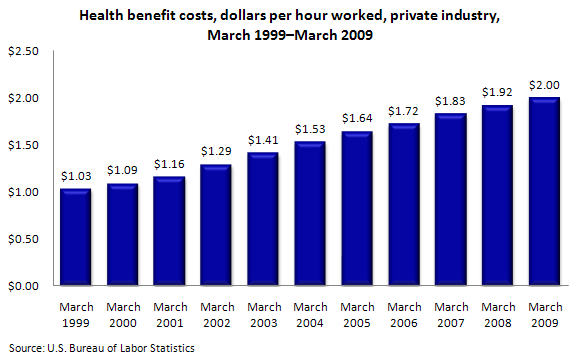

Health insurance costs to employers and employees, 1999 to 2009 : The Economics Daily : U.S

Employers Paying More, Workers Getting Less for Health Insurance Health insurance

2015_5516_RePrism: When Mobile Technology meets Health Industry \u2013 A marriage made in heaven?

Political Calculations: The Cost of EmployerProvided Health Insurance in 2016

Such article How to choose a Health Insurance Plan Health Life Media

You are now reading the article How to choose a Health Insurance Plan Health Life Media with the link address https://insurancenetworkhealthy.blogspot.com/2018/07/how-to-choose-health-insurance-plan.html

0 Response to "How to choose a Health Insurance Plan Health Life Media"

Post a Comment